CarMax: Lasting Moat in a Tough Industry

CarMax is down almost 40% from its recent highs, and is a staple holding among several legendary value investors. Even though it has bounced off of the March lows, it still looks cheap on a historical basis and has compounded value for investors in the past.

CarMax operates in a difficult industry. Just because an industry is tough and competitive, it doesn’t mean it’s un-investable. Just look at Buffett, who owns plenty of businesses in capital intensive and cyclical industries despite preferring to own capital-light compounders. For me, investing in these spaces, like always, requires finding a business that has a sustainable competitive advantage that is likely to continue for many years. It also requires a higher margin of safety (i.e. a lower price to value) than may be required when investing in a great business.

CarMax is the largest player in the used-car market, but does it have a real moat protecting its leading position? If so, what price affords enough margin of safety to earn a solid return, and what will those returns look like? I’ll try to answer each here.

Moat

When I think about CarMax, “data” is not the first word that comes to mind. However, since splitting from Circuit City in the ‘90s CarMax has built a formidable lead in used car data that is the foundation and reinforcer of their moat. This data allows CarMax to provide an easier and more enjoyable car buying experience for customers, propelling it to the top of its industry.

I know of few people who look forward to bartering over the price of a car, and CarMax is well known to employ “no haggle” pricing on its inventory. Further, sales associates are incentivized on a fixed-dollar commission and therefore can refrain from being pushy towards customers on certain cars or products. These customer-focused concepts seem easy in theory, but are very hard for competitors to implement in practice without an exceptional pricing process. There is a reason that CarMax is the only significant retailer that holds this promise, and why 99% of the cars they sell are sold at retail price.

How have they been able to accomplish this? The company has spent several decades building and refining a pricing model that allows them to move inventory quickly and avoid marking down cars causing a major drag on already thin margins. The company has three main things going for it which enable a massive edge in accurately pricing its inventory:

experience

a unique appraisal/trade-in program, and

necessity

Experience

CarMax’s experience edge doesn’t need much explaining. The company has been engaging in used car sales since splitting from Circuit City in the ‘90s and has built a database from the millions of cars bought, sold, and appraised. Capturing all aspects of car buyer preferences – make, model, color, location, price, etc. – over many years is not something that a start-up, or industry incumbent that hasn’t been collecting as rigorously, can replicate. CarMax has built an increasingly wide gap here simply because they’ve been at it so long.

Appraisal Program

Most auto dealers allow buyers to trade in their car only if the customer is buying a car from the dealership. Conversely, CarMax will buy any car that someone drives onto the lot, bringing multiple benefits along with it. First, this process allows CarMax to build a vast selection of inventory at all of its locations, providing customers with more choices. Second, each of these transactions feeds the company valuable data on local buyer preferences and pricing. Third, only about half of the cars that the company buys from customers are re-sold, the other half go to the company’s vast auction process, providing another income stream. Finally, as the company discloses in their 10K, the units purchased from customers are more profitable than those purchased at auction. In a commodity business like cars, low costs win. CarMax’s low cost of inventory is a difficult model for competitors to replicate.

From this appraisal process, CarMax operates the third largest wholesale auction in the country, generating $2.4B of revenue last year. Engaging in the auction market provides still more real-time insight into the market, further enhancing pricing accuracy, and allows the company to round-out their desired inventory mix.

Necessity

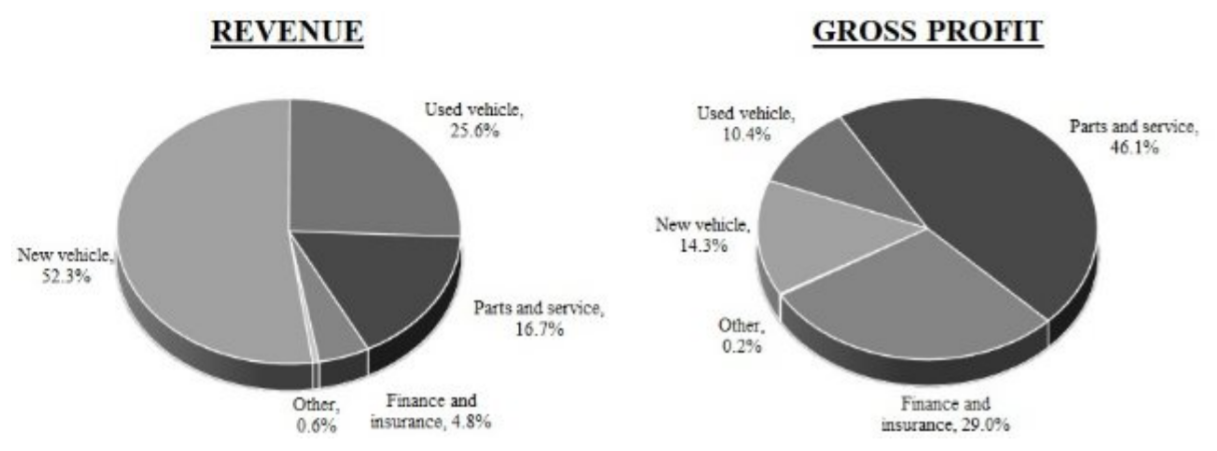

Finally, a more qualitative but equally important edge that has driven CarMax to industry leadership - necessity. Most dealers follow a razor blade model. New and used vehicles are the razors that the company makes very little money on in proportion to revenue, and ancillary services - such as parts and services and financing - are the blades that generate the majority of the profits. As shown below, AutoNation, the second largest industry player behind CarMax, generated 46% of its gross profit on parts and service despite that segment representing less than 17% of revenue.

source: AutoNation 10K

Taking a look at Lithia Motors; parts, service, and financing/insurance operations accounted for 15% of revenue and 61% of gross profit. It’s a theme you’ll see again and again in the auto dealership world, except at CarMax. The company does operate a financing division which accounts for about 35% of operating income, the rest comes from buying and selling used cars.

Because of this dynamic, competitors simply don’t have a reason to optimize their used car selling process, as it isn’t the main driver of their business. CarMax lives and dies by selling used cars, and its existence depends on pricing their inventory correctly. They have chosen to focus on an area that is largely ignored by others creating less competition and threats of new entrants. Other car dealers look about as cheap as CarMax, such as Lithia and Group One, and could provide great returns at recent prices as well. However, these companies are more susceptible to competition in the areas they shine, making them less predictable and harder investments for me. Coincidentally, this aspect is an overlapping element of our recent investment thesis in NVR, which you can read here. Relentless focus on a piece of the business that competitors ignore can produce great returns, no matter the industry.

To summarize, CarMax has built an immense used car data set through many years and their unique appraisal process. This in turn allows them to optimize pricing and inventory to provide an improved customer experience through increased selection and no-haggle pricing all without sacrificing profitability. This model has propelled CarMax to dominate the used car industry with plenty of room to run. Taking all of this into account, CarMax’s moat is much stronger than I initially realized, which begs the question – what will it be worth in the future?

Growth

The used car market is massive and highly fragmented. CarMax is the largest used car dealer in the nation, selling about 750K cars last year. Despite being the top player, they hold just a 4.7% market share in 0-6 year old models, up from 4.4% in 2018 (source: 2020 10K) and less than 2% of the 40 million total used car sales.

Given how fragmented this market is, the opportunity for a long growth runway should be there.

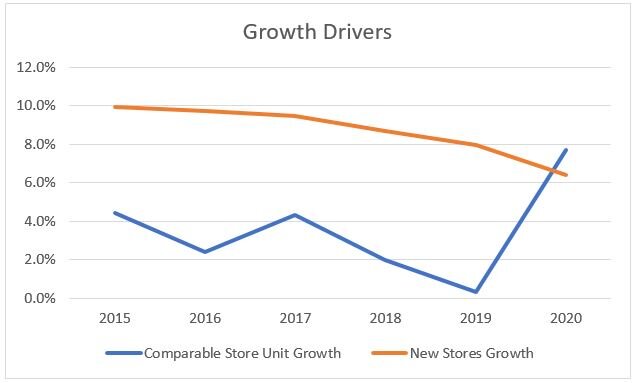

Like most retail outfits, the main drivers for topline growth are comparable stores sales growth and new store openings. Since FY2015 this is what the trend has looked like.

Any single year can be choppy on the unit growth side, and new store openings have slowed a bit as the company has rolled out the Omni channel sales model, but overall in a normalized environment it seems reasonable to assume high single digit topline growth from comparable store sales growth and new store openings. This compares to a 10%+ CAGR in revenue over the last decade.

Aside from comp growth and store openings, prices could have a dramatic impact on bottom line growth. Luckily CarMax is reasonably well insulated from swings in used car prices. The company targets a fixed dollar gross profit per car, not gross margin percentage. As shown to the right, because of their pricing model they have been surprisingly consistent on a gross margin per unit basis across the cycle and a range of used car pricing conditions.

Gross profit per unit isn’t primarily dependent on vehicle prices, but a variety of factors including inventory turns, mix of vehicles sourced from the appraisal process, reconditioning costs, and wholesale vehicle pricing. Profit spiked at over $3,000 per unit in 2011 temporarily because of a favorable mix of all of the above factors, but otherwise has remained right around $2,000 for over 15 years. A year or two here and there can be expected on either side of the average, but on balance this key metric has held steady and is what investors should focus on. The company outlines this aspect further in their annual reports for those that are interested. This is important because it shows their pricing model has staying power over a range of market conditions. All signs point towards the future looking like the past, which makes assessing future returns doable.

Valuation and Expected Returns

To get an idea of intrinsic value growth we need to get a sense of incremental return on capital and reinvestment rate. CarMax is a bit trickier than an average retailer because they have a financing division, CarMax Auto Finance (CAF), that finances a little less than half of CarMax’s customers. The non-recourse debt from this division is consolidated on CarMax’ balance sheet, but should be stripped out from the core business to understand how each segment will grow. Obviously, the earnings from the financing arm need to be stripped out along with the non-recourse debt when looking at just the core business.

Below I break out the expected returns from the core business (selling cars at retail and auction) and CAF, the financing division. For the core business, I look at “core” capital invested (change in net debt and equity) vs. “core” EBIT growth to get an idea of how the business should compound based on incremental return on invested capital (I-ROIC) and reinvestment rates. After making these adjustments, since 2010 CarMax’s core business has earned very respectable pre-tax incremental returns on capital of close to 20%. The business reinvests roughly half of these earnings resulting in an 8% annual compounding rate.

CAF’s profit growth is driven by the margin it earns on managed receivables and receivable growth. Since launching this program in 2010, managed receivables and CAF income have grown 13% and 11% annually. Average margin has been 5%. As a base case I assume that the financing mix has matured after the last 10 years and average receivable growth will be roughly in line with revenue growth (high single digits) annually. I also assume margin compresses to 3% of receivables as provisions for credit losses increase. Even though CAF only finances prime buyers, the recent spike in unemployment should have an impact on loan losses for a few years. This would result in CAF income growing at 5% annually.

Per ValueLine, CarMax has traded at a median valuation of 17x earnings since 2009 and the stock currently trades at ~12x last years’ earnings. Obviously 2020 can essentially be written off because of COVID-19 so things need to be normalized and an investor needs to be thinking out several years when making an investment here. Assuming that’s the case, and CarMax can realize anywhere near the growth above, the market would certainly value it substantially higher than 12x, and likely at least at its historical average of 17x earnings.

Combine the growth in intrinsic value with share repurchases adding another ~4% (likely higher if the company can start buying back stock anywhere near current prices) as has been the case in the past, and I can see core eps growing at 11+% annually for many years – pretty solid. Also, the company should realize some operating leverage as they scale SG&A across a larger revenue base and spending tapers off from the launch of the new Omni channel sales initiative.

A re-rating to the median valuation of 17x earnings over 5 years would yield a total return on the stock (from intrinsic value growth, buybacks, and re-valuation) of almost 20% annually, as shown above.

Risks

CarMax faces a handful of key risks. There have been a few deeper dive articles posted on SeekingAlpha recently that did a nice job outlining CarMax’s liquidity situation so I won’t go into great detail other than to say I don’t believe the company is in any danger of survival because of the recent shutdowns. Surviving the Coronavirus aside, I see a few main areas to consider.

First, anytime a business has an internal financing division, there is an element of credit risk. Given CAF only finances prime purchasers and securitizes the debt, I just don’t see a massive risk lurking in the shadows. It’s certainly something to consider monitoring, though.

Second, current and new competitors could take share from CarMax. There has been a lot of noise from Carvana and other online focused car retailers in recent years, but I don’t worry too much about them. First, Carvana doesn’t turn a profit, and nearly collapsed in recent months. Second, CarMax has a solid online platform for those that wish to complete the entire purchasing process online (see right). Finally, I don’t foresee a situation where physical locations of dealerships become irrelevant, or even greatly diminished. To the vast majority of the population, physically seeing, picking out, and driving your car is too important to render dealerships useless.

Lastly, obviously the auto industry is cyclical and sensitive to economic conditions. At 12x last years’ earnings the current valuation prices most of this in, in my opinion. Certainly in March when the company traded at around 7x earnings they were priced for disaster for those that were willing to step in and buy.

Conclusion

The businesses that are around for the long term are the ones that make things easier for their customers. CarMax has developed a model for buying and selling used cars that is different than its competitors and makes the car buying experience better and easier. They’ve spent decades building a moat in a tough industry and I don’t see that moat eroding any time soon. Couple that with the fact that the industry is highly fragmented and CarMax should continue growing at a solid normalized rate for years.

I wouldn’t fault anyone for buying CarMax at current prices of around $60 per share. That said, because I classify CarMax as a good business in a tough industry I am looking for a bit larger margin of safety and higher prospective returns than when buying a great business in a great industry. If CarMax comes anywhere near retesting its recent lows and trades down to 9x earnings or lower (high-$40s per share) there’s a good chance I would buy some and be thrilled about doing so. Returns from those levels could easily exceed 25% annually for 5 years or more.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.