Dollar General: Relentless Growth

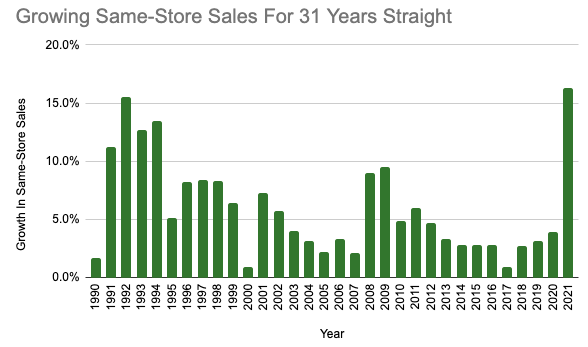

Dollar General is a beast. They've grown same-store sales for 31 years in a row, straight through recessions, pandemics, wars, and bubbles. I'm not aware of any retailer that can match its record. Not even Walmart can match that record.

Dollar General's growth isn't just steady. It's counter-cyclical too. It grows fastest when the economy suffers most, so it's no surprise then that 2020 was a banner year. Same-store sales grew 16.3%, the most in thirty years.

Source: Author, Data From Company Filings

Dollar General is also remarkable for how quickly it builds new stores. Store count has increased from 1,284 in 1991 to 17,177 today, a 9.0% compound annual growth rate.

Source: Author, Data From Company Filings

Growth has moderated to 6.6% over the last five years, but this is still remarkably fast given the company’s size. Last year they opened 841 stores amidst the pandemic and this year they’ll open 1,050. That’s about 20 new stores a week.

The million-dollar question is, will the future look like the past? To figure that out, it helps to understand precisely how Dollar General pulled this performance off.

Avoiding Competition

Dollar General sells a mix of national brands and private-label merchandise. 75% of sales are consumables like toilet paper, frozen pizzas, shampoo, and beer. The rest are seasonal, home, and apparel products.

It’s not what Dollar General sells, but where, that’s remarkable. It focuses on small, rural communities that large grocers and Walmart avoid. 75% of stores are in towns with less than 20,000 people. Often, the closest grocery store to these towns is 20-30 miles away. A trip there could require an hour of round-trip driving. Dollar General offers convenient one-stop shopping for mid-week "fill-in" trips for essential items.

Most retailers chase scale by building stores in densely populated and affluent cities. Dollar General has done the opposite. By going where others didn't, it carved out a profitable niche for itself.

A Battle-tested Moat

That's not to say Dollar General has never gone head-to-head with a competitor. Retail is fiercely competitive, and Dollar General's profits have attracted all sorts of competitors over the years. The most formidable was Walmart.

In 2011 Walmart began rolling out Walmart Express stores in the rural south. Stores were small — about a tenth as large as a Walmart — and meant to compete head-on with Dollar General. But, by 2016, Walmart had had enough. They closed all 102 stores and even sold 41 to Dollar General.

Walmart failed because running a small, rural dollar store is an entirely different game than running a Walmart or Sam's Club. Despite Walmart's procurement advantages, the Express stores didn't mesh well with Walmart's existing supply chain.

There are 4,743 Walmarts in the U.S., and they average 180,000 square feet. By contrast, there are 17,717 Dollar Generals, and they average 7,400 square feet. Walmart built its supply chain to serve a smaller amount of centralized, high-volume stores, while Dollar General built its supply chain to serve many more dispersed, low-volume stores.

Dollar stores are like a reverse-Costco. 80% of Dollar General's merchandise costs less than $5, and the average basket is five items for $12. Dollar General has suppliers make smaller items to keep prices low. If you're used to shopping at Costco, you might call Dollar General's products "travel-sized."

Most of Dollar General's customers live paycheck to paycheck and buy small quantities because it's all they can afford. According to Fortune, 57% of Dollar General's customers have household incomes below $50,000, and 30% are less than $25,000. That's well below the U.S. average of $69,000.

Source: 2016 Investor Day Presentation

Remarkably, Dollar General's prices still match Walmart's on a per-unit basis. Low prices and narrow margins don't leave much to cover shipping and distribution, so efficiency is paramount. The only way to get that efficiency is to build a supply chain designed explicitly for serving lots of small, rural stores. When Walmart figured this out, they threw in the towel.

Low prices, low margins, and rural customers mean e-commerce companies like Amazon don't pose an imminent threat. There's not enough margin to cover last-mile delivery, especially in the countryside.

Low-Cost Producer

The key to Dollar General's low prices is its no-frills operating model. Stores are bare-bones boxes built in rural areas on dirt-cheap land. They are small and only require 2-3 employees at any given time. Unlike many grocers, they have no unions or legacy pensions. Stores stock about 10,000 SKUs, about 20% of a conventional grocer, to aggregate buying power and minimize complexity.

Dollar General gains further efficiency by self-distributing, which cuts out middle-men, increases margins, and decreases stock-outs. It also lets them push their private label products harder.

Finally, they do lots of other small but not insignificant things like in-sourcing fleet maintenance, centralizing procurement, zero-based budgeting, and tracking KPIs using apps. They’re a data-driven culture that is constantly tweaking and testing new ideas.

Dollar General is good at day-to-day blocking and tackling. It's unsexy, relentless grunt work but critically important. All the little things add up over time into a formidable moat.

Spending Other People’s Money

One tool Dollar General uses particularly well is build-to-suit leases. Dollar General promises to rent a store if a developer builds one to their exact specifications. The leases typically run fifteen years with either flat rent or escalators every five years. Cap rates are usually in the mid-single digits. These are slim margins for developers, but Dollar General offers developers who perform plenty of volumes to make up for it.

That Dollar General uses build-to-suit isn't remarkable. The scale of their program is. This year Dollar General will open over 1,000 new stores, and most of them will be built-to-suit. Volume allows Dollar General to extract discounts from developers and minimize its already modest rents.

Build-to-suit drives strong unit economics for Dollar General. Developers typically spend about $1.5 million to deliver a store. Dollar General's out-of-pocket costs are just $250k for fixtures and inventory. On average, stores are cash-flow positive within their first year and pay for themselves inside of two years.

This run-rate implies that Dollar General's initial $250,00 investment produces $500,000 of profit in 3-4 years. That's a 19-26% annual return. High incremental returns on capital have pushed Dollar General's ROIC and ROE trending higher over time. Last year they hit new highs at 24% and 36%.

Source: Author, Data From Company Filings

Widening The Moat

Retail is a tough business because you must earn your customer's business every day. If Dollar General doesn't continue to improve its value proposition, its customers will go elsewhere. The company has several initiatives in place to improve quality and reduce costs.

Their biggest push is to increase the number of coolers in each store. Coolers allow stores to stock more perishable goods, like fresh meat, dairy, and produce.

The cooler initiative dovetails with the DG Fresh initiative to self-distribute refrigerated and frozen food. DG Fresh improves margins and reduces stock-outs. DG Fresh now reaches 16,000 stores and is almost complete.

Fast Track is an initiative to optimize goods for stocking while they're still at distribution centers. Fast Track will improve labor productivity in stores.

The Non-Consumable Initiative (NCI) brings rotating seasonal home and decor merchandise to stores. More frequent product changes drive more frequent traffic, and NCI merchandise has a higher gross margin than consumables.

Finally, Dollar General has an app called DG Go! where customers can get coupons and check prices. Dollar General uses coupons to highlight its value proposition and convince customers to do more shopping with them.

Forward Returns

Now that we understand why Dollar General has been so successful, we can ask, will the future look like the past? While there are no guarantees, I'd bet it will at least resemble it.

Same-store sales growth and store count growth are the twin engines propelling Dollar General's earnings higher. Both appear intact for the foreseeable future.

Same-Store sales

In their most recent earnings call, Dollar General guided for same-store sales to decline 4-6% in 2021. The reason is simple: it's hard to lap 2020's explosive growth. While the company's 31-year streak might come to an end, that shouldn't bother long-term investors.

So long as Dollar General maintains its low-cost advantage over rivals, it should continue to grow sales per store. Dollar General's moat is under constant attack, but so far, it has proven resilient.

To maintain its moat, Dollar General will need to continue to execute its initiatives. Any margin expansion gained from improved efficiency will probably need to be reinvested into low prices to stay one step ahead of the competition. Nick Sleep calls this Scale Economics shared. When done well, it unleashes a positive feedback loop where low prices drive higher volume, which pushes prices even lower.

Same-store sales have grown 6% per year over the last 31 years against a backdrop of 2.4% inflation. As the world becomes more competitive and the easy pickings are gone, I'd expect the margin of growth over inflation to narrow but remain positive.

New Stores

As Dollar General has expanded, they've consistently revised their total store opportunities upwards too. They did it most recently on their last earnings call. Dollar General now sees opportunities for 13,000 more small-box retail stores. Though anyone could build these, Dollar General is well-positioned to take the lion's share.

Thirteen thousand new stores are enough to drive 6% store growth for eleven years. History suggests Dollar General will probably identify even more opportunities between now and then.

Source: 2020 Annual Report

As Dollar General grows, it will run a greater risk of cannibalizing its existing stores. It will also run into its rival's turf as it tries to move upmarket.

For example, Pop Shelf is a new concept they're just beginning to roll out. It aims to sell cosmetics and home decor to suburban women. Pop Shelf is a step upmarket for Dollar General. Could it be a step outside of their core circle of competence? Five Below has proven that these concepts can be incredibly profitable, and the potential returns are enticing. While I'm optimistic, I also worry about Dollar General straying too far from its roots, as Walmart did with Walmart Express.

Yield

Eventually, there will come a day where Dollar General has saturated the country with stores. When that happens, I hope they turn all of their free cash flow towards repurchasing shares. Given their counter-cyclical cash flows, this could be particularly lucrative.

I'm optimistic about future capital allocation and share repurchases for two reasons. First, William Rhodes III is on Dollar General's board. He's the President and CEO of AutoZone, a company that knows a thing or two about capital allocation and stock repurchases.

Second, Dollar General already buys back a lot of shares. Over the last decade, they have spent about half of their earnings on buybacks. Share count declined 3.5% per year while stock averaged a 17x price-to-earnings multiple.

Additionally, Dollar General began paying a dividend in 2015. The stock has traded at an average yield of 1%.

Putting it all together

2-4% same-store sales growth (against 2% inflation), 6% store count growth, and 4-5% yield between buybacks and dividend totals 12-15%. These are well-above-average returns available at the market's average price (22x earnings).

Dollar General is a good reminder that investors don't need to wade into high-multiple tech stocks with murky futures to get above-market returns. Dollar General has a proven recipe for success, a plan to continue replicating it, and a long runway ahead.

Risks

Dollar General's success is due to game selection (going where the competition isn't) and execution. Retail is tough and will probably only get tougher. Dollar General will need to continue to invest in lower prices to maintain its status as a low-cost producer. This will limit operating leverage.

As the incumbent with scale, it has advantages. But maintaining those advantages will require a lot of day-to-day blocking and tackling. Management has proven that they're capable of this, but that doesn't guarantee success.

As Dollar General expands, it will inevitably have to move into its competitor’s markets. Its supply chain may not be as well suited to competing in urban and suburban environments as it is in rural towns. Incremental opportunities may be less profitable.

Management uses data to monitor incremental returns and store cannibalization, so they should know when enough is enough. When they've run out of growth, I expect them to direct virtually all of their free cash flow towards repurchases. If they do something else, there's a risk they'll waste the money.

Overall, I'm willing to give management the benefit of the doubt. They have steered the ship through every conceivable type of weather over the last 30 years and always come out on top. The following 30 years may not be quite as rosy as the last, but they still ought to look pretty good.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.