GameStop: New Generation, No New Lessons

In 2003 Mohnish Pabrai penned a letter on the perils of short selling. In it, he mused “Capitalism has a few other things to offer that are as entertaining as witnessing a short squeeze.” I think anyone following GameStop recently would agree.

Nearly every news publication has recently covered the GameStop saga. Assuming everyone is at least somewhat familiar with the situation, I’m not going to rehash all of the gory details here. Many have done a better job than I can of explaining what’s happened in detail, with Matt Levine offering perhaps the best overview as things unfolded in real time. Now that it appears the drama is unwinding as the stock crashes back to earth, it seems like a good time to explore some of the interesting aspects of what happened and what investors will hopefully take away.

Quick Recap

GameStop operates a money-losing collection of over 5,000 retail outlets that sell video games and gaming systems across the country. The company’s fundamentals have been deteriorating for some time and the business has teetered around bankruptcy in recent years. The stock was high risk/high reward when it was priced at ~$8/share last year, as an unlikely revival in the company’s prospects would mean a dramatic rise in its stock price. Alternatively, there was a real chance the equity could be worthless.

GameStop has long been a favorite target of short sellers, with more than 100% of the company’s tradable shares (or float) sold short. This played a huge role in the stocks subsequent meteoric rise.

In September 2020, with the stock price hovering around $8/share, Chewy founder and e-commerce guru Ryan Cohen disclosed a ~10% stake in GameStop. In January Cohen and two affiliates won board seats and the stock rose 20%. Investors hoped Cohen could help spur the company to cut costs and ignite growth in e-commerce.

All bubbles start with a nugget of truth, and indeed Cohen joining the board appears to be a good thing for GameStop. However, many years of hard work and execution will be required to turn around the business. As investors cheered this news, a short squeeze began to form.

By mid-January the stock had 5x’d to over $40/share and the Reddit page “Wall Street Bets” had taken the stock market by storm. By the end of January the stock was over $300/share, up over 1,600%. One now famous Reddit user who bought $50K worth of call options from his basement in 2019 was sitting on profits of over $40M by the end of January. The daily screen shots of his “YOLO” GameStop trade will go down in internet lore and landed him on the front page of the Wall Street Journal.

Astonishingly, there were trading sessions when more than $20B worth of GameStop shares exchanged hands – more than Apple, the world’s largest company by market cap. As I write this it seems the GameStop trade is in the process of unwinding as the stock has dropped to under $55 and likely headed back to its pre-bubble levels in short order.

Resemblance to Other Bubbles

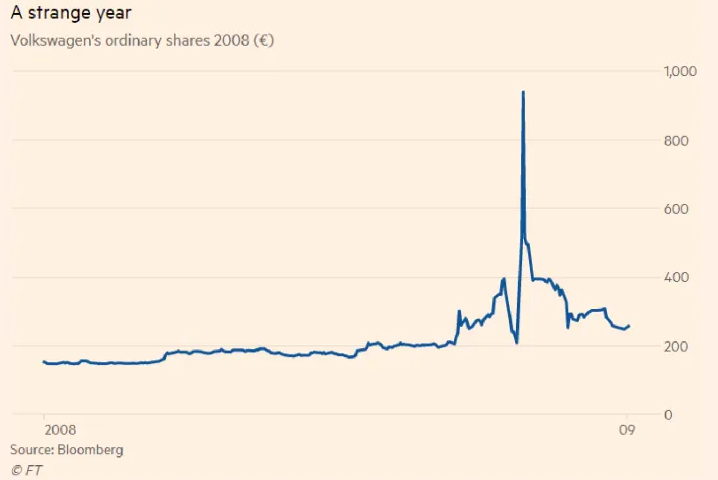

GameStop appears to be the first instance of Reddit users and gen Z speculators experiencing the thrill of a short squeeze, but it’s far from the first, or largest. Short squeezes have been around as long as financial markets. In 2008 Volkswagen briefly became the most valuable company in the world after Porsche purchased loads of its stock in the face of high short interest. Here’s what VW’s stock price looked like that year.

Source: Financial Times

Bubbles, whether in individual stocks or markets as a whole, tend to follow the same pattern, which looks something like this.

A final similar chart shows one of our favorite bubble stories which we’ve alluded to before – Sir Isaac Newton getting swept up in the South Sea Bubble. It’s a great reminder that even intelligent people do dumb things in the market, especially when their friends are getting rich quickly.

Source: https://twitter.com/petershk/status/1356632022953848837

One fact that seems lost on many investors is that bubbles neither create nor destroy value, they simply transfer wealth. Unless GameStop completes a secondary offering and actually raises cash, the artificially inflated stock prices does not make the business intrinsically worth more than before the bubble. In this case wealth was transferred to early GameStop investors from short sellers who were forced out and bag holders who bought at the top. Early investors exit with a profit while remaining shareholders suffer from the stock’s inevitable decline.

Securities prices move far more widely than the underlying value of the businesses they represent, and bubbles take this to an extreme. In a supposedly efficient market why do things like this still happen?

Mechanics of a Short Squeeze

For those interested in the technical aspect of what occurred, GameStop’s absurd rise was caused by two factors – a traditional short squeeze and the heavy use of options.

A short squeeze is fairly straightforward. Short selling is selling shares by borrowing them with the hope to buy them back, or “close” the position at a lower price in the future, pocketing the difference. When investors short a company’s shares and anything causes the price to rise modestly, some short sellers may close their position by buying shares, taking modest losses. This demand for shares causes the price to rise, inflicting more pain to short sellers that remain in the trade. The high short interest of GameStop exacerbated this feedback loop. Because more than 100% of the company’s shares are shorted, in effect there weren’t enough shares available for short sellers to buy in order to close their positions. This created a stampede of short sellers rushing to buy shares in hopes of getting out as quickly as possible, which drove a furious rally in price. This classic short-squeeze dynamic was exacerbated by unusually heavy option volume.

Armed with stimulus checks in hand, free options trading on Robinhood, and the encouragement of thousands of other risk-embracing Redditors, retail investors bought GameStop call options in droves. Because a call option gives the option holder the right to buy a certain amount of shares at a pre-determined price, when a dealer sells an option they often buy the corresponding amount of shares to hedge against sharp price movements up in the stock. If they did not hedge the position, they would need to pay a much larger price at a later date to buy and deliver the shares to the option holder if the option is exercised. The more option contracts that were purchased, the more GameStop shares the option dealers bought, creating another positive feedback loop for GameStop’s stock price.

Obviously, everything I’ve described is purely technical in nature and fully divorced from GameStop’s fundamentals. When these technical factors subside the share price is sure to be lower, probably by something like 80-90%, but who knows. In the stock market, only the marginal buyer and seller set the price. Existing holders get no vote. As soon as everyone with enthusiasm has voted, prices will revert. Last week may have marked the top from the confluence of these factors, or maybe more madness is yet to come. What I find even more interesting than the epic GameStop short squeeze is the sprawling ramifications no one saw coming from a seemingly small corner of the market.

Collateral Damage

Contagion from GameStop quickly spread across financial markets. As GameStop ripped higher, other stocks with high short interest began rising in sympathy. Heavily shorted AMC (the near bankrupt movie theatre chain) rose 300%+ and Bed Bath & Beyond doubled in price as retail investors and momentum funds latched onto whatever might be the next victim of a short squeeze. Meanwhile, hedge funds with short exposure were crushed.

From a combination of large short bets and heavy use of leverage, Melvin Capital, run by Steve Cohen protégé Gabe Plotkin, suffered a 53% decline in January. At the end of 2020 Melvin managed $12.5B, a figure that has sunk to ~$8B, which includes a $2.75B capital injection from Citadel and Point 72 to stabilize the fund. Melvin had previously been one of the markets top performing hedge funds since debuting in 2014. Many other large hedge funds suffered similar losses stemming from their short book.

Robinhood, the fintech darling and popular trading app which helped enable GameStop’s rise, was the next casualty. The company was forced to raise $3.4B between Thursday January 28th and Monday February 1st - more than the company has raised in its entire prior existence. Robinhood halted trading for GameStop and numerous other highly shorted stocks, leading to outrage among retail investors who quickly spawned conspiracy theories that Robinhood was acting at the behest of sinister Wall Street hedge funds trying to stem losses. In reality, Robinhood had to halt trading in these names to save itself from a major liquidity issue.

Trading platforms like Robinhood have to back up trades with clearing houses in case Robinhood users are unable to pay for losses on trades. This is usually no problem, but when volatility spikes, clearing houses demand significantly more collateral to protect against trades falling through and major disruptions in public markets. Clearing houses demanded billions of dollars of capital from Robinhood and other platforms to backstop losses that may result from rapidly moving stock prices, and it was money Robinhood didn’t have. Several other broker dealers, such as TD-Ameritrade, Interactive Brokers, and Schwab also elected to halt trading as a matter of internal risk management, not to protect hedge funds, though Robinhood got most of the bad press from upset users.

Vlad Tenev, Robinhood’s founder, went on CNBC after restricting GameStop trades and said the company was not facing a liquidity crisis. Clearly, there was. Or, they were worried about one happening. But, to admit a financial institution is in the throes of a liquidity crisis would cause a run on the bank and ensure Robinhood’s demise. So Robinhood was between a rock and a hard place. Lie (or, bend the truth, depending on how literally you define liquidity crisis) and sow the seeds of conspiracy theories, or be honest to a fault and likely go bust.

As recently as December Robinhood had grand plans to go public in a white-hot IPO market. As of Monday those plans were shelved.

Finally, as hedge funds scrambled to cover short positions when it appeared no price was too high for these stocks, the S&P fell by more than 3% for the week, its worst week since October. Fund managers were forced to liquidate their long positions to cover their short positions, leading to blue chip names falling as businesses who were dancing around bankruptcy briefly soared. There’s nothing like having to sell your winners to cover your losers. Talk about a weird week.

Takeaways

These situations are always amusing to watch from the sidelines, and I try to use them to reinforce principles that have persisted throughout financial history. Here are a few lessons to stash away for the next financial craze.

In the short-term, anything can happen in interconnected financial markets. Random events can wipe out the unprepared and overextended.

This past week is a reminder of one of Ben Graham’s great quotes. He said that “in the short run, the market is a voting machine but in the long run, it is a weighing machine”. For stock prices, over short time periods, emotions matter more than fundamentals. But ultimately cash flow is what matters, and those who purchased GameStop at recent prices are being reminded of this iron law.

Strange things happen frequently in the stock market, but they seem to happen infrequently enough to consistently burn investors who haven’t learned from history. Both sides of the GameStop trade can now attest to this. Excessive use of leverage, complex financial products like derivatives, and short selling (which can produce unlimited losses) have ruined intelligent money managers and retail investors alike for centuries. Investors chasing quick and easy returns refuse to learn.

After losing more than 50% of its value in one month Melvin Capital now needs to return over 100% just to get back to where it started the year. On the back of leverage and short selling Melvin had been one of Wall Street’s best performing hedge funds until it got creamed by option-wielding Robinhooders. Likewise, investors who bought in at the peak of the GameStop mania have experienced an ~80% decline in three days (who knows where the stock will trade when I publish this article).

We’ll never use leverage or short sell at Eagle Point Capital – it’s not worth the risk and it would keep us up at night. We prefer to set ourselves up to withstand random short-term market dislocations, and ideally take advantage of them. We do this by owning simple, predictable, and profitable enterprises. This will result in less exciting returns over the short-run than if we leveraged our portfolio, but we’ll never blow up from taking undue risk or engaging in activities that we don’t understand. To be successful over the long-term, the first requirement is to survive for the long-term, and trying to manufacture returns is a good way to permanently impair capital.

Besides reminding us to avoid some of these classic investing pitfalls, the last few weeks provide some helpful insight into the current mood of the financial markets.

Taking the Temperature of the market

I’ll never make bold and broad prognostications about the stock market or economy, though I certainly try to have a grasp about where we stand in the economic cycle. Howard Marks calls this “taking the temperature of the market”. This is helpful when positioning yourself from defensive to aggressive throughout a market cycle, both of which can be done while remaining fully invested.

Matt wrote about many examples of financial euphoria at the end of 2020. Between nosebleed valuations of money-losing companies, a SPAC mania, and IPOs regularly doubling in value within days of hitting the market, the market pendulum appeared to have swung quite far in the optimistic direction. All of that was before the retail mania hit GameStop.

Robinhood’s trading app was downloaded more than 600,000 times on January 29th alone. This compares to 140,000 downloads during the height of the market turmoil last year on the apps most active day. Christopher Nagy, director of Healthy Markets Association recently told the Wall Street Journal the “last time the environment was this good for retail market-makers was back in the dot-com bubble”. Historically, unbridled enthusiasm and activity from retail traders and speculators have marked the last leg of stock market up-cycles. Maybe we’ll look back on January 2021 as one of those times. Or maybe not. What I can say is the temperature of the market seems to warrant closely evaluating risk at a time when many are embracing it no-holds-barred.

Buffett says “the less the prudence with which others conduct their affairs the greater the prudence with which we must conduct our own affairs”. Accordingly, we’ve shifted our portfolio a bit to what I would describe as “defensive growth”. Companies drowning in cash that are poised to grow regardless of extrinsic factors fit this description nicely. We’ll discuss a handful of new positions in our upcoming spring letter.

Disclosure: The author, Eagle Point Capital, or their affiliates may own the securities discussed. This blog is for informational purposes only. Nothing should be construed as investment advice. Please read our Terms and Conditions for further details.